Stop Chasing Ghost Buyers – Here’s Why You’re Broke

Wholesaling looks simple from the outside—find a deal, flip it, cash out. But if you’re trying to build a buyers list for real estate before you’ve got anything worth selling, you’re setting yourself up for a crash. Most new investors get suckered by guru talk that tells you to stockpile cash buyers before you even sniff your first deal. They’ll say you “need to know what your buyers want” before you go hunting for properties. Truth? That’s backwards as hell. The only thing you should be targeting is the right property at the right price—the kind of deal that makes real estate investors reach for their wallets, fast.

Deals First, Buyers Second – That’s How the Real Money’s Made

If you want to start wholesaling real estate like a pro, stop obsessing over your cash buyers list and start obsessing over the deal. The power is in locking down a wholesale real estate contract that’s so good your phone melts from all the buyers calling. A motivated seller with a distressed property at the right numbers? That’s your golden ticket. Once you’ve got that, potential buyers will find you—hell, they’ll be fighting over the chance to take it.

If you want motivated sellers reaching out to you, this guide shows how to use bandit signs to generate real calls.

Recognizing a Real “Hot Deal” Before You Look Like a Rookie

A “hot deal” isn’t just some wholesale houses ad with lipstick on a pig. It’s an investment property in a solid neighborhood that a retail buyer will eventually drool over. Your end buyer should be able to rehab it properly—not some duct-tape patch job—and still sell it at or above market value with room for profit. Real estate wholesalers who understand this don’t waste time on junk; they know experienced investors only move on properties that make sense after all the fixed costs and the resale math is done.

How Being Disorganized Can Burn Your Whole Operation Down

Rolling into a deal without a system for handling buyers is like running into traffic blindfolded—you might get lucky, but probably not. Without a process, you’ll be buried under Facebook messages, random calls, and emails from fake “potential cash buyers” who can’t close. Some are just other real estate wholesalers fishing for your deal so they can try virtual wholesaling it to their own list. If you wait until you’ve already signed a wholesale real estate contract to go hunting for a buyer, you’re in panic mode. That’s when you make bad calls, skip due diligence, and risk losing your wholesale fee, your deposit, or the whole damn deal.

Quit Hoarding a List Full of Tire Kickers

Some of you brag like it’s a badge of honor: “I’ve got a buyers list with 20,000 names.” Congrats—you’ve basically built a spam list full of dead weight. A bloated cash buyers list is useless if those people never buy wholesale properties or even look at your deals. Most of these so-called potential buyers are other new investors, fake real estate investors, or people who don’t have the significant capital to close. It’s not about collecting contacts—it’s about building a lean list of real estate wholesalers and flippers who are actually closing deals in the local market.

Your Email Blasts Are Hitting the Trash, Not the Bank

You can spend hours writing that perfect email, loading it with photos of your latest investment property, even bragging about how it’s the best deal in town. But here’s the reality: most of your “list” will ignore it. People are drowning in marketing noise, and if your offers aren’t targeted, they’re just more clutter. This is why successful wholesalers don’t rely only on email—they mix in calls, texts, and even direct mail campaigns to the right buyers. And when you’re hustling the right way, you’re sending wholesale real estate opportunities that match the buyer’s criteria, not just shotgun-blasting every distressed property you find.

Beware the Daisy Chain Parasites

If your buyer vetting sucks, you’ll attract the wrong crowd—other real estate wholesalers looking to hijack your deal. These “daisy chain” players don’t have an assignment contract ready; they just want to tie up your property so they can shop it to their own list of potential cash buyers. Some will even try to snake you by contacting the property owners directly. This kind of nonsense wastes time, kills your credibility in the real estate industry, and can tank your wholesale deals before you ever get near the closing table. Protect your wholesale fee like it’s rent money.

Google-Stalking the Players Who Pay to Play

If you want real cash buyers, think like a desperate seller. Jump on Google and type “sell my house fast [your city]” or “we buy houses [your city].” The people paying big money to rank for those search terms are the real sharks in the real estate market. They’re not broke new investors with pipe dreams—they’re seasoned real estate investors with significant capital, proven investment strategies, and the ability to close without drama. These are the folks who actually buy wholesale properties, not just talk about them on Facebook.

Mining Zillow and Redfin for Investor Gold

You want to see real estate investing in action? Search “recently sold” on Zillow or Redfin in your local market for the last 12 months. Look for phrases like “as-is,” “investor special,” or “fully renovated” in the property descriptions. That’s your breadcrumb trail to experienced investors who are flipping or holding investment property. Pay attention to quick flips—when the sale history shows a home bought for peanuts and resold at a higher price in months—that’s a sign of a legit buyer. They’re the ones who can become your final buyer again and again.

Craigslist Ain’t Dead—If You Work It Right

Most rookies use Craigslist to blast their junk wholesale deals, hoping someone bites. Flip that game on its head—search the “housing” section for ads from people looking to find cash buyers or buy houses directly. These sellers-turned-buyers are actively spending time and effort to source undervalued properties in your area. This is free intel and a straight shot to adding the right kind of buyer to your network without breaking a sweat.

Bandit Signs: The Street-Level Market Pulse

You’ve seen them—“We Buy Houses” and “Sell Quickly for Cash” signs posted at busy intersections and near distressed property neighborhoods. Those aren’t random—they’re marketing efforts from real real estate wholesalers and flippers actively buying houses in your area. Grab the number, make the call, and find out if they’re in the market for exclusive deals. You’ll be surprised how many are willing to share what areas they’re targeting and the specific neighborhoods they prefer.

Stop Hiding Behind a Screen and Start Shaking Hands

Get off your laptop and start hitting local real estate networking events. These are loaded with real estate investors, rehabbers, and sometimes even real estate agents who specialize in working with flippers. Meet them, talk deals, and you’ll learn how they operate. The bonus? You might also find motivated sellers through referrals in those rooms. Nothing builds trust faster than a face-to-face handshake when you’re trying to build a long-term pipeline of motivated sellers and solid end buyers.

The Street-Level Sniff Test for Fake Buyers

Before you waste time on some clown who just learned the term “wholesale real estate,” give them the sniff test. Do they talk a big game but can’t explain a single real estate transaction they’ve done? Do they claim they have a real estate license but hesitate when you ask for their brokerage info? A legit buyer doesn’t flinch when you check their background—they know you’re protecting your deal. Your gut will often tell you if you’re talking to a real closer or a wannabe.

“Show Me the Receipts” or Get Lost

One question separates the real real estate investors from the frauds: “Give me the last three properties you bought for cash.” A real buyer has no problem handing over addresses, letting you verify ownership in public records. This is a step too many new investors skip, and it’s why they get burned. If the name on the deed doesn’t match, you’re probably dealing with someone who’s flipping contracts without the skills, the funds, or the strong negotiation skills to finish the job.

Will They Let You Get Paid?

A true player doesn’t care about your assignment fee as long as the numbers work. If they start sweating over you making $30K, $50K, or more, they’re the wrong end buyer. Professionals care about profit margins, not your payday. Anyone who tries to cap what you earn is a red flag—drop them and move on to buyers who understand the hustle.

Testing Their Buying Capacity Without the BS

Talk is cheap. If they say they can handle multiple projects, ask them: “If I bring you three flipping houses opportunities next month, can you close on all three?” If they hesitate or admit they haven’t bought much recently, they’re not your priority. Real buyers are actively hunting in both familiar areas and new markets. They’ve got the cash, the crews, and the investment strategies ready to move on the best deals without delay.

Proof of Funds or No Deal

Always verify proof of funds—it’s not optional. Ask for a bank statement or a letter from a hard money lender that shows they can close now, not after begging for a loan. Compare their numbers to the purchase price and run your own math on the maximum allowable offer. A real buyer will pass this check easily, while a pretender will scramble for excuses. Skipping this step is how you end up wasting weeks and losing deals to financial difficulties you could’ve spotted on day one.

Quit Using Your Brain as a Filing Cabinet

If you’re trying to run real estate wholesaling deals by keeping buyer info in your head or scattered across text messages, you’re asking for chaos. The second you get a hot right property under contract, you’ll be scrambling and losing time. Start simple—use a spreadsheet to track the serious players. When you’re moving multiple wholesale deals a month, upgrade to a CRM. Online platforms like Podio, Go High Level, or Follow-Up Boss will keep your cash buyers organized, your follow-ups on point, and your marketing efforts tight.

The Non-Negotiables You Need to Track

Every real buyer profile should include the basics—name, phone, email, and company name—but that’s just the start. Record the specific neighborhoods or zip codes they target, the type of wholesale houses they want, and their ideal price range. Track how many deals they closed last year, their go-to funding source, and even their preferred contact method. The more you know, the faster you can match them with exclusive deals and earn that assignment fee without wasting time on tire kickers.

Dial in Their Buy Box Like a Pro

Don’t just guess what your real estate investors want—ask. Do they prefer light cosmetic updates or full rehabs? Are they buying for flips or rentals? Do they focus on single-family homes, investment property portfolios, or undervalued properties in up-and-coming local markets? When you know their exact buy box, every deal you send will feel hand-picked, which makes them more likely to pull the trigger fast.

Sorting Buyers by Stage to Maximize Closings

Your list isn’t just a contact dump—it’s a sales machine. Break your buyers into stages like: “New Lead,” “Interested,” “Running Numbers,” and “In Negotiation.” This helps you spot bottlenecks—if you’ve got a ton of “Interested” but no offers, it’s time to push harder. Real successful wholesalers treat their buyers list for real estate like an active pipeline, not a dusty Rolodex. That’s how you keep wholesale real estate deals moving and avoid having properties sit while your competition scoops up the best deals.

Text Over Email – The Modern Power Move

Email’s cool for follow-ups, but if you want buyers to actually see your wholesale real estate deal, text them. This isn’t 2008—people live on their phones. Text messages get seen instantly, while emails rot in spam folders. A quick text about a right property in a hot real estate market beats a long email any day. If you’re smart, you’ll have a VA firing these out for you while you’re chasing your next deal. The key factors here? Speed and precision—only text the people who actually close.

Stop Spamming Junk Deals

Every time you send a property that’s outside a buyer’s criteria, you’re training them to ignore you. The pros in the real estate industry don’t waste time on mismatches—they send wholesale properties that line up with buyer preferences in terms of location, budget, and rehab scope. Targeting the right buyers means more real estate transactions and fewer dead leads. Send a junk deal to a heavy hitter in the flipping houses game, and you might never hear from them again.

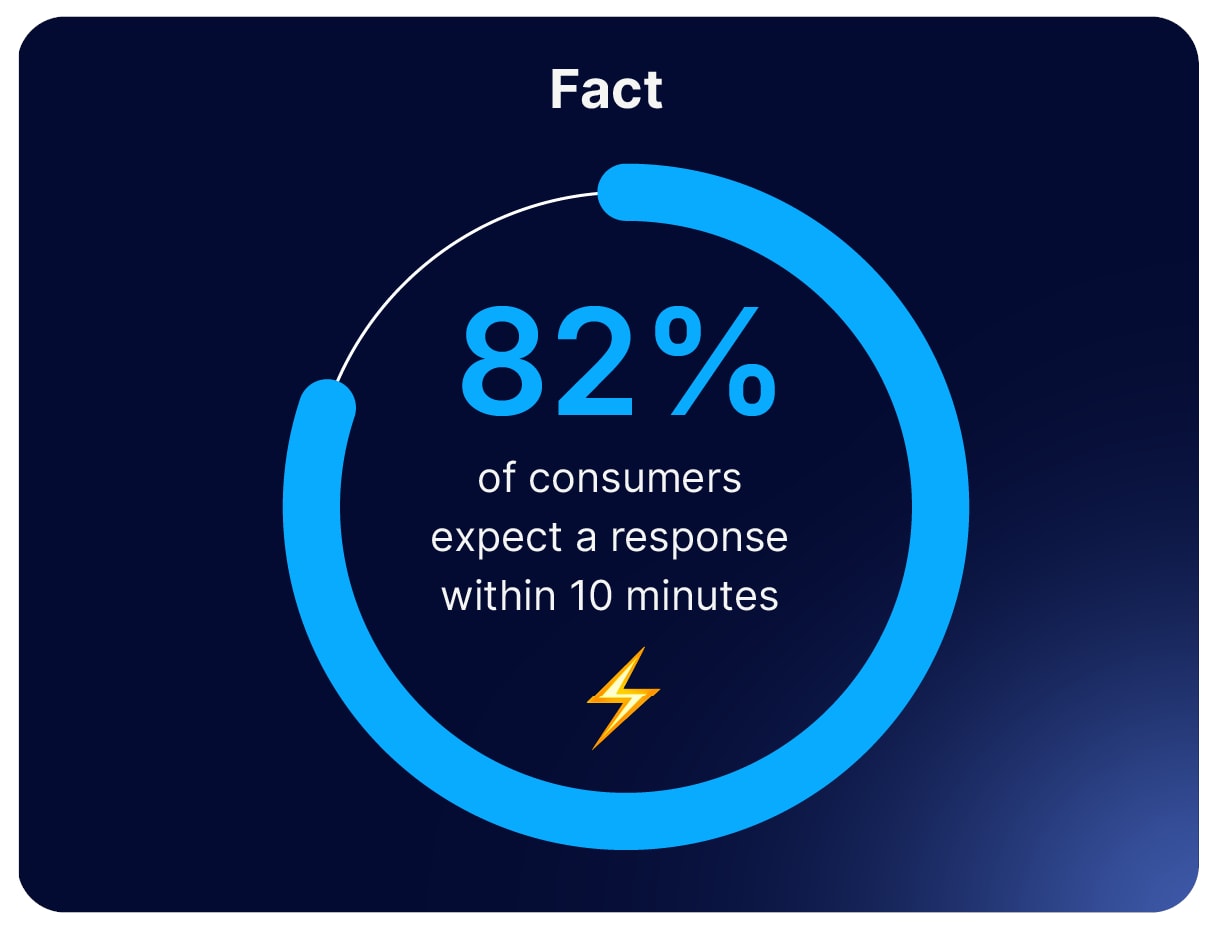

Your Slow Response is Killing Your Closings

In this business, time kills deals. If a buyer calls or texts and you take half a day to respond, they’ve already moved on to someone else. Real buyers, especially those working on many properties, don’t sit around waiting. They’ve got crews, deadlines, and financial risk on the line. Be quick, be sharp, and make it easy for them to say yes before the purchase price becomes yesterday’s news.

Relationships That Actually Pay

Stop thinking of your buyers as one-time customers. Build relationships so they keep coming back for more. Maybe that real estate investor who bought your last deal now wants help finding their next project, or they can connect you with property owners looking to sell. A strong network can even help you secure the right mortgage later if you shift from wholesaling to holding properties. Long-term money comes from trust, not just transactions.

Multi-Channel Communication Wins the Game

Don’t limit yourself—hit your buyers from every angle. Text, call, email, voicemail drops, even targeted Facebook ads if that’s your style. The best in real estate wholesaling use every tool in the box to make sure the best deals don’t slip by unnoticed. And sometimes? You’ve just gotta pick up the phone and have a real conversation—because a deal can be worth way more than the couple of minutes it takes to seal it.

The Tease Text That Gets Buyers Lined Up

When you’ve got a hot wholesale real estate contract locked down, don’t blast it to your entire list of cash buyers right away. Instead, hit up your best players first—the ones who’ve closed exclusive deals with you before. Send a short, urgent text: “Got something you’ll want to see—need a yes or no in the next hour.” You’re creating FOMO and showing them you’re not desperate. A serious final buyer knows if they snooze, they lose.

Get the Price Commitment Before the Walkthrough

Don’t let people waste your time. Before setting foot in the property, get them to commit to the total property price—pending it matches the photos and description. This weeds out the tire kickers and protects your time for the strong negotiation skills you’ll actually need when a real offer comes in. Anyone who can’t make a conditional commitment isn’t serious, especially if they’re working with very little capital and hoping to shop the deal.

Follow-Up Like a Closer, Not a Rookie

Most real estate transactions die in silence because the wholesaler never circles back. If a buyer says no, ask why. If it’s the purchase price, use their feedback to renegotiate with the seller. If it’s repairs, get quotes and adjust. A smart real estate wholesaler uses objections as leverage to make the numbers work. This is how you turn “no” into “send me the contract” without losing face.

Lock It Down with Non-Refundable Earnest Money

Always secure a non-refundable EMD—think $1K to $5K, or around 1% of the total property price. This is your insurance against flakey buyers and a guarantee they’ve got skin in the game. If they push back hard, that’s a sign they’re not the final buyer you want to close with. Protecting your wholesale fee isn’t just smart—it’s survival. In this game, the deal’s not done until the wire hits your account.

Why I Nuked Most of My List and Never Looked Back

At the end of last year, I checked my numbers: we sold 38 wholesale real estate deals. Guess how many buyers were responsible? Eleven. That’s it. Out of hundreds of names, only 11 people actually closed. Some folks on that list had seen dozens of exclusive deals and never pulled the trigger. Under the state laws where I work, my time is worth more than babysitting dead leads, so I cut them. If they can’t sell quickly or close after seeing the best deals, they’re gone.

Small List, Big Money

A bloated list is just noise. I’d rather have 10 rock-solid real estate investors who can close on many properties each year than 1,000 “buyers” who waste my time. When your list is tight, you learn exactly what each player wants, you deliver it fast, and you make more per deal. That’s when you stop chasing and start controlling the flow of wholesale real estate opportunities. It’s not about how many people know your name—it’s about how many people wire you money.

Quit Playing Around and Build a Real Business

If you’re serious about making money in wholesale real estate, stop acting like this is a side hustle you can wing. Build your base with a handful of real estate investors who can actually close. Focus your marketing efforts on finding motivated sellers, locking down properties at the right numbers, and protecting your assignment fee like it’s the last dollar in your account. The game is about control—controlling deals, controlling timelines, and controlling who gets to buy from you.

Level Up From Wholesaler to Ultimate Investor

Wholesaling is just the launch pad. If you play it right, it becomes your on-ramp into real estate investing that includes flips, rentals, and even developing in new markets. That’s how you build generational wealth—by moving from active income into passive streams that pay you even when you’re not grinding. Keep the systems you’ve built, the buyers you’ve vetted, and the lessons you’ve learned. Then start stacking assets until you’re calling all the shots and no one can tell you when the deal’s over—because you own the deal.

Pro-Level Moves to Supercharge Your Buyers Game

If you think you’ve mastered wholesale real estate, you’re probably still leaving money on the table. The real killers in this business don’t just flip contracts—they work every angle to find motivated sellers, lock in the right deals, and make themselves impossible to compete with.

First off, understand your numbers. Market value isn’t just a guess—it’s your foundation. You need to know exactly what a property will pull on the open market, so you can price your wholesale real estate deals in a way that makes motivated sellers happy and keeps your buyers lining up. That’s how you justify a higher price without losing momentum.

And here’s something I see rookies screw up all the time—getting their real estate license. Yeah, I know, you don’t need one to start wholesaling real estate, but having one in your back pocket opens doors. You’ll get access to the MLS, be able to talk numbers with agents without looking like an amateur, and you’ll have an edge in new online platforms where licensed pros get priority listings.

Speaking of online platforms, they’re not just for listing houses—use them to spy on competition and buyers. Sites like Redfin, PropStream, and even Facebook Marketplace are goldmines for leads if you know how to filter. You can spot motivated sellers based on how long a property’s been sitting and even uncover virtual wholesaling opportunities in other markets without leaving your desk.

If you’re not running direct mail campaigns by now, you’re slacking. Yes, everyone loves digital, but a killer postcard or letter in the right mailbox can still pull crazy response rates—especially in older neighborhoods where sellers aren’t glued to their phones. Pair that with cold calls, skip tracing, and the right online platforms to keep your funnel full.

Here’s the part most people don’t want to hear: you’ve gotta go deep in your market and expand smart into others. This means knowing every zip code, every pocket where you can find motivated sellers, and every block that’s primed for virtual wholesaling when you’re ready. Keep a heatmap of the best areas for quick flips and note where you can push a higher price without buyers blinking.

And don’t sleep on the human side. If you’re grinding in wholesale real estate, make sure your relationships are built on trust. Buyers need to believe you’re bringing them real value, not just throwing whatever deal you found on Zillow at them. This comes from accurate comps, fast communication, and knowing how to frame a deal so it’s irresistible.

Bottom line? Whether you’re still trying to start wholesaling real estate or you’ve been in the game a minute, you can’t get lazy. Keep feeding your list with high-quality properties, stay ahead of the competition with data-driven market value analysis, and use every tool—real estate license, direct mail campaigns, online platforms, and virtual wholesaling—to keep yourself in the winner’s seat.