What the Hell Is a Proof of Funds Letter?

Let’s get this out the way: if you’re trying to wholesale houses and don’t know what a proof of funds letter is, you’re already behind. It’s not optional—it’s the price of entry.

A proof of funds letter (or POF letter) is a document that tells the real estate agent, seller, or bank that you’ve got the cash to close the deal. Whether it’s your money, your buyer’s, or a lender’s doesn’t matter—what matters is that the letter proves you’ve got funds to make it happen.

Why Wholesalers Need It Even More Than Buyers

Traditional real estate investors might have bank accounts to flash. You? You’re playing the middle. That’s what makes a solid funds letter your secret weapon. It lets you compete with people who’ve actually got the money in hand.

If you’re making real estate offers without a POF letter, you’re a ghost buyer—and agents can smell that from a mile away. Don’t expect your contract to get accepted if you’re missing the basics.

Free Proof of Funds Letter for Wholesaling? Hell Yes.

Here’s the best part: you don’t even need to be rich.

Sites like DoubleClose and BestTransactionFunding offer a pre approval letter—no credit check, no questions. Just fill out the form with the property details and you’ll get a professional-looking PDF form in your inbox.

This ain’t fraud. This is using tools made for the hustle. These lenders want you to win because if you do, you’ll use their services. It’s how the real estate wholesaling game works when you actually learn how to move. Be it hard money lender or a bank. If you have action they want in. They can’t get paid if they waste opportunities.

Who’s Gonna Ask You for One?

Let’s not play dumb. You’ll be asked for a proof of funds letter when dealing with:

- REO agents

- Bank-owned properties

- Short sales

- Experienced sellers

- Tired real estate agents who’ve been burned before

Sometimes even potential sellers—like old-school landlords or people who’ve been hit with multiple “ghost buyers”—will demand to see proof before they bother negotiating.

The Fastest Way to Get One (Without Fronting)

If you’ve got a legit buyer on your team, you can ask for their bank statement or official POF letter. If they’re serious, they won’t hesitate. If they do? Move on. You don’t have time for broke investors who just want to tag along for your good deals.

Still building your buyer list? That’s when a free proof letter from a transactional funding site steps in. These sites are built to serve other investors—people like you who just need the document to open doors.

Proof That Closes Deals

Let’s get one thing clear: a proof of funds letter doesn’t guarantee a win. But not having one guarantees you’ll lose.

This letter gives you something 90% of wannabe wholesalers don’t have—credibility.

The market’s tight. Real estate agents are jaded. Sellers are suspicious. Show up with a clean proof of funds, and you’re walking in like a pro. Show up empty-handed, and you’ll be tossed out with the tire kickers.

The Power of Making Offers with Confidence

If you’re afraid of making offers because you don’t have your proof of funds ready, you’re not in the game—you’re still in the parking lot. That hesitation costs you good deals every damn day.

Once you have a solid POF letter, you stop tiptoeing. You feel like a real estate investor. You start submitting aggressive offers. You walk into a real estate deal knowing your paperwork is tight and your story checks out.

That’s how pros move. They don’t wait to get asked—they send their proof in with every offer, no questions.

When you’re ready to make an offer, having the right contract matters. This is the exact wholesaling contract we use so you can move forward without guessing.

Get Your Buyer’s POF—If They’re Real

You don’t always need to come up with your own funds letter. If your buyer is serious, they’ll have one ready. Ask them straight up: “Can you show me your latest bank statement or your official POF letter?”

If they stutter, stall, or dodge it, walk away. There are too many real estate investors with actual capital ready to move. You need closers, not talkers.

And yeah, once you’ve got that POF, you can attach it to your contract and make your offer stronger—just make sure it matches the deal terms.

Secure the Deal with Hard Money Muscle

Sometimes your buyer ain’t ready or the seller wants a faster close. That’s when you bring in a hard money lender.

These lenders don’t care about your credit score. They care about the numbers and the property. If it makes sense on paper, they’ll fund it.

A hard money loan usually closes in days—not weeks—and most lenders will give you a custom proof of funds letter just for applying.

That’s leverage. And it’ll help you secure deals you’d normally lose.

Don’t Sleep on Transactional Funding

When you’re assigning contracts or doing double closings, transactional funding steps in. These lenders cover the A-to-B part of the deal for you, often using your end buyer’s money to fund the front side of the close.

It’s fast. It’s clean. And it’s one of the smartest financing tools for new wholesalers with no cash of their own.

The best part? Transactional funders usually give you a proof of funds letter up front to help you lock in the real estate purchase. Just don’t mess around—they’ll want a real contract and a ready-to-close buyer.

Why Lenders Want You to Look Legit

Here’s the truth: lenders want you to win. The faster you close, the faster they get paid.

So yeah, they’ll help you look the part. Some will even give you a pre approval letter in hopes you’ll use their money later.

Think of it as a business handshake—they’re backing you on the front end, hoping you’ll bring them a loan on the back.

Make Sure Your Numbers Match the Paperwork

When you’re submitting that POF letter, double-check everything. The property address. The purchase price. Your company name.

If anything’s off, the real estate agent will toss your offer or put you on the “do not answer” list. This is a common pitfall for many real estate newbies who are not aware of the intricacies of the process.

One mismatch can kill a deal. So slow down, double-check the document, and make sure your numbers are bulletproof.

Real Estate is a Business—Act Like It

Real estate investors know one thing. If you’re out here treating wholesaling like a side hustle, you’ll keep getting side hustle results.

This is real estate investing, and everything about how you present yourself needs to scream business.

That starts with having your proof of funds letter locked and loaded. No guessing, no waiting for someone to ask. You send that document in with every offer like a professional.

Pros know: perception is everything. The POF letter proves you’re not just another rookie trying to scrape together a deal—you’re someone who came to secure it.

Leverage Multiple Services for Flexibility

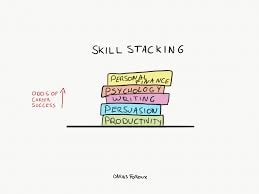

Here’s a move most beginners miss—stack your sources.

Don’t just get one POF letter from one hard money lender or transactional funding outfit. Have a lineup of different services ready to go. That way, no matter what type of real estate purchase you’re chasing, you’ve got the right paperwork to match.

Some letters work better with banks. Others hit harder with real estate agents or private sellers. Rotate as needed, but always keep them fresh and current.

How to Handle a Last-Minute Request

Ever had an agent hit you at 9PM on a Friday needing a proof of funds ASAP?

If you’re not prepared, you’ll miss the deal. And trust me, someone else will close it before Monday.

That’s why you have a system. Save your letters in a secure cloud folder. Label each by buyer, company name, and price. Stay ready so you don’t have to get ready.

These real estate transactions move fast, and no one’s waiting on your email excuses.

Build Credibility by Looking the Part

You don’t need a fat wallet to be taken seriously. What you need is credibility.

Having a clean, consistent funds letter, sharp documents, and real numbers shows people you mean business—even if you’re wholesaling your first property.

The market is full of talkers. Real closers don’t talk. They submit.

Every little detail—from your email signature to your PDF form—matters. When buyers, agents, and sellers see you operating like a pro, you’ll get more callbacks and more chances to win.

Money Moves Without Emotion

Don’t get emotional when someone questions your funding. It ain’t personal. It’s money.

Sellers want to know they won’t be left hanging. Real estate agents want to close. And lenders? They just want to get paid.

So instead of taking it as an insult, use the question to flex: “Absolutely—I’ve attached the latest proof of funds letter from my buyer’s lender.” That’s confidence. That’s how you flip suspicion into respect.

Know Your Numbers or Get Exposed

Nothing kills a real estate investment faster than bad math. If you’re gonna represent your buyer, know their budget.

If you’re gonna pitch a deal, know the rehab. Know the loan limits. Know how the capital flows.

Because once someone sniffs out that you’re faking it, they’ll ghost you forever.

Use your proof of funds the right way. Back it up with real info. That’s how you build trust, land contracts, and scale this thing past one lucky break.

Proof of Funds in the Digital Age

No need to beg a banker or print some dusty form. Getting your proof of funds is as easy as filling out a quick online request.

Transactional lenders and hard money outfits now offer digital services that’ll generate a clean, custom PDF form with your buyer’s info, property address, and purchase price in minutes.

You can even do this from your phone while walking a property. That’s how modern hustlers stay dangerous in this game—by being fast, mobile, and papered-up.

Use Financing to Buy Time

If you can’t close with your cash buyer or they flake, don’t panic.

Tap a hard money lender or a transactional funding company that offers short-term financing. Some will cover the whole deal for a small fee and help you close the A-to-B side of your contract while you resell it on the B-to-C.

This lets you secure the real estate purchase without using a dime of your own money.

That’s how you buy time—and buy time means you buy options.

Always Secure Your Buyer Early

Let’s be real. The time to find a buyer is not after you’ve signed the contract—it’s before.

Line up your contact list early. Know who’s got enough money to fund your flips, rehabs, or rentals. Know who’s fast and who flakes.

Every real closer in this business has a list of verified buyers they can call in their sleep. If you don’t, you’re not running a business—you’re gambling.

Houses Don’t Sit Around Waiting

The market is too hot to play slow. Distressed houses get scooped up fast by seasoned real estate investors and tight-knit crews who don’t hesitate.

You want to compete with that? You need your POF letter, your loan strategy, and your buyer lined up before you even call the agent.

Wholesaling’s not a race—but it sure ain’t a picnic. Get out of rookie mode.

Stack Your Services for the Future

Think ahead. You’ll do more real estate transactions down the road, and they’ll all require the same thing: proof you’re for real.

Start building relationships now with services that’ll ride with you for the future—transactional funding, hard money lenders, and verified buyers who back your play.

Keep your files updated. Track who’s fast, who funds, and who disappears when it counts.

Your credibility tomorrow is built on the work you do today.

Make Your Contact List Gold

Here’s a secret no guru tells you: the richest asset in this business is your contact list.

Your buyers, your lenders, your go-to services—those names are your currency. Protect them. Feed them. And use them wisely.

Because when a seller needs to move fast and the agent needs someone solid, guess who gets the call?

You. If you’re ready.

Making Offers That Get Noticed

There’s a big difference between making offers and making offers that actually get taken seriously.

You can shoot off contracts all day, but if your email doesn’t include a solid proof of funds letter, you’re wasting everyone’s time—including your own.

Attach your document. Show your numbers. Look professional. And match every contract you send to the property and price in your POF letter.

That’s how you get agents to open your email instead of sending it straight to the trash.

The POF Is the Close Before the Close

Want to sell your ability to close without begging? The proof of funds is the close before the close.

It’s what gets your real estate purchase moved to the top of the pile.

Sellers don’t want promises—they want proof. Agents don’t want stories—they want documents. Buyers want you to be organized, quick, and ready to secure the deal.

This one letter—this one piece of paper—can make or break your entire transaction.

Wrap-Up: Your Credibility Is Earned in Advance

In this real estate game, credibility doesn’t show up at closing—it shows up at offer time.

The wholesalers who win don’t just know how to talk. They know how to present. Their paperwork’s tight, their terms are clean, and their proof of funds is ready before anyone even asks.

You want to close more deals? You want to look like a pro even when it’s your first contract?

Then remember:

- Get your POF letter lined up

- Keep your details clean

- Stay ready, not reactive

- And never—ever—show up empty-handed

That’s the MOB way.