The Real Talk: Quit Claim Deeds Ain’t What You Think

Let’s get one damn thing straight — it’s “quit claim deed,” not “quick claim deed.” If you’re out here saying it wrong, you’re already looking like a rookie. Fix it before you embarrass yourself at the county clerk’s office.

Now that we’re clear on that, let me tell you why this topic’s blowing up. Ever since I dropped a few gems about targeting quit claim deeds in your marketing, y’all been sliding in my inbox like I opened a secret stash of gold bars. Most folks are chasing foreclosures or probate like zombies, but this? This is that off-radar list that can change your game overnight — if you know how to work it.

This ain’t a list full of handouts. It’s for real hustlers who aren’t afraid to get their hands dirty digging through public records. You want less competition, more hidden gems, and a shot at real property ownership? Then listen up — we’re diving into the trenches.

What is a Quit Claim Deed, Anyway?

Let’s break it down like I’m talking to my nephew. Or niece, I have both.

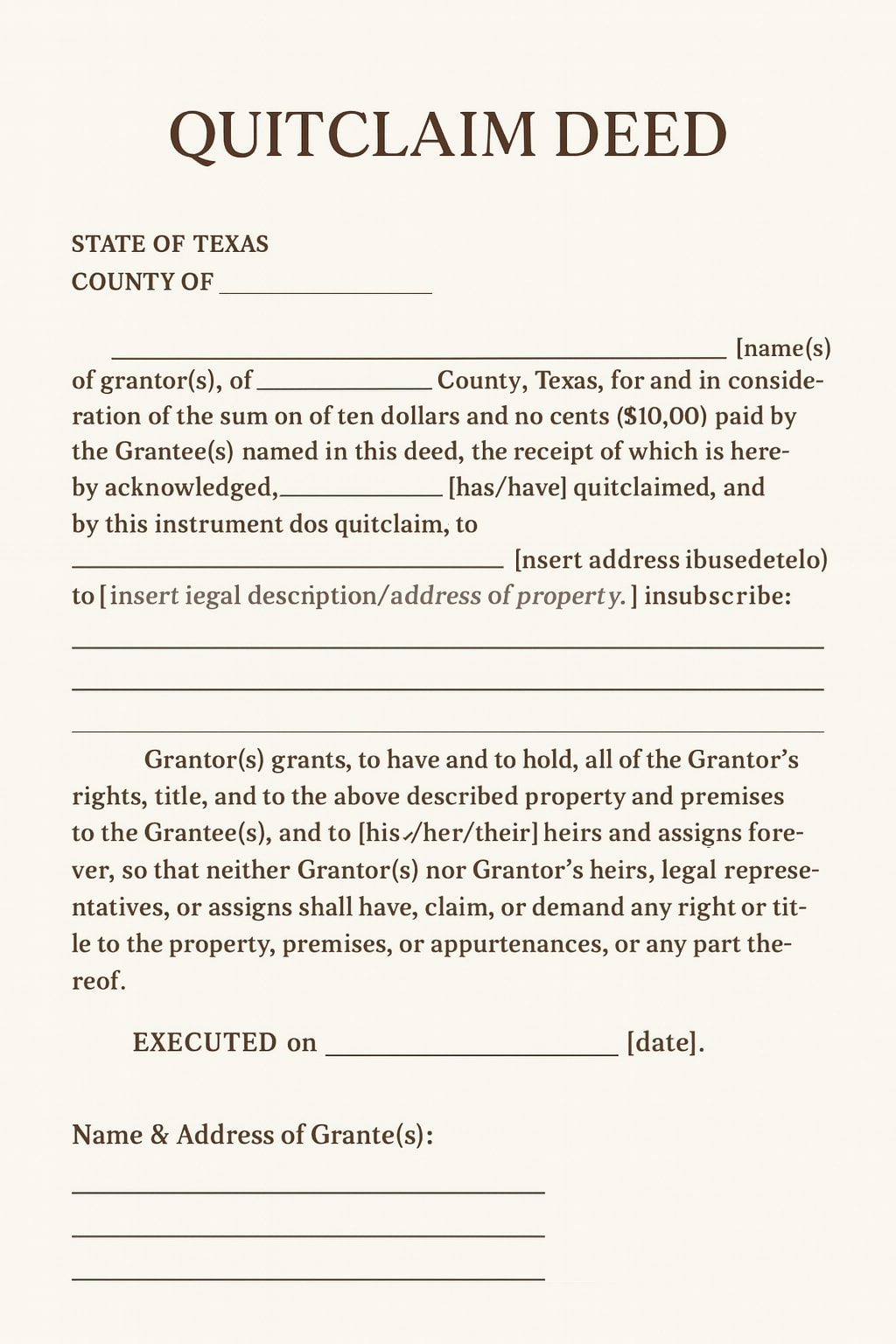

A quit claim deed is a legal document used to transfer property from one person to another. Simple, right? But here’s the twist — it transfers whatever ownership interest the grantor has… even if that interest is hot garbage.

No warranties. No guarantees. No “clean title.” It’s basically like saying, “Yo, whatever piece of this house I got, you can have it — but don’t come cryin’ if it ain’t what you thought.” That’s what makes a quit claim powerful and risky all at once.

So if you’re thinking it works like a warranty deed — nah, player. That’s a whole different beast. With a warranty deed, the property title is promised to be squeaky clean. Not the case here.

If you want motivated sellers reaching out to you, this guide shows how to use bandit signs to generate real calls.

Why These Deals Are Gold: The Untapped Motherlode

Here’s the thing: these deals don’t come easy — and that’s exactly why they’re gold. Most wholesalers are too lazy to chase ‘em. That’s good news for you.

When you find a quitclaim deed, chances are, you’re uncovering a specific circumstance that other investors ain’t even thinking about — like divorcing spouses, close family members, or someone just trying to move something off their books fast.

Less eyes on these deals means more leverage for you. You wanna stop competing with 400 wholesalers for one burnt-out landlord? Start looking for quitclaim deed transfers and ownership interest swaps that never hit Zillow or the MLS.

The Hidden Gems: Real-World Scenarios for QCs

Let me paint a few gritty pictures:

- A buyer ghosts their private lender and instead of dragging through court, the lender gets the property back via quitclaim. Boom — property transferred with no public drama.

- Two heirs inherit a house. One’s in jail, the other just wants to sell. The first one quitclaims his share. That’s your off-market payday.

- Mama trying to keep the house out of estate planning purposes hands it to her daughter before the Medicaid sharks circle. Another low-key transfer.

These don’t show up on list brokers’ dashboards. You gotta know what you’re lookin’ for — and how to listen when someone mentions they used a quitclaim deed in their past.

Hunting for Quit Claim Deeds: Your Digging Guide

Ready to hustle? Cool. But don’t think you’re just gonna Google this stuff.

Step 1: Call your county clerk’s office. Ask how quitclaim deeds are logged. Some label ’em “non-warranty” transfers. Others hide ’em under low-dollar transfers.

Step 2: Search public records or property title websites. Look for sales between $0 and $100. That’s usually a legal description of a quitclaim transfer.

Step 3: If the county’s stonewalling you, call a list broker. Some got their own ways to pull deed form data, especially in investor-heavy markets.

Remember: if it’s easy, it’s not profitable. These ain’t arms length transactions — they’re messy, quiet, and full of potential.

Deed Deep Dive: QCs vs. The Real Deal

Alright, let’s get this tattooed on your brain: a quitclaim deed offers no damn guarantees. None. Zip. Nada. It don’t promise you a clear and marketable title, and it don’t vouch for valid ownership. You’re takin’ whatever property interest the seller’s got — even if that interest is dust.

On the other hand, you got warranty deeds, which are like the big dogs of real estate transfers. A general warranty deed? That sucker backs the property title all the way down the bloodline — past owners, hidden liens, title defects — the whole shebang. It says, “This is my house, clean as a whistle, and I’ll back that up in court.”

Special warranty deeds are more like “meh” deeds — they only promise the property ownership was clean during the time that seller owned it. Still better than nothing, but not a full ride.

Moral of the story? If someone offers you a quitclaim, you better know exactly what you’re stepping into.

The Ugly Truth: Why Sellers Push QCs

Listen close — if a seller’s pushing for a quit claim deed and dodging any conversation about title insurance, you better smell what they’re cookin’. It ain’t cookies, it’s straight-up sketchy behavior.

People push quitclaims when there’s something hiding in the shadows: unpaid liens, disputes, maybe even a fraudulent deed in the mix. They don’t want a title search because they know it’ll turn up skeletons.

So if the seller’s actin’ nervous and refusing to use a general warranty deed, you need to back up and reassess. That deal might already be rigged.

The “Stinks Up The Deal” Factor

Picture this: you’re at the closing table and the seller says, “Oh, we’re just gonna use a quitclaim deed instead of all that fancy title work.” Nah. That’s how you end up owning a problem — not a property.

If they’re dead set on skipping a proper deed form, that ain’t just a red flag — it’s a damn fireworks show. Using a quitclaim deed in that kind of situation kills the vibe, spooks buyers, and leaves you holding a ticking time bomb.

Your time is money. Don’t waste either messing with someone who’s hiding trash under the rug.

Fraud Alert! Don’t Get Screwed

Scammers LOVE using quitclaim deeds to pull off shady transfers. Why? Because they avoid the systems built to verify identity — like the notary public, the title company, or the county clerk.

So here’s the million-dollar question: Is the person transferring the property even the legal property owner?

If they’re pushing to avoid a title search, or refusing to bring in a third-party to verify the deal, it might be time to bounce. These folks prey on rookies who don’t understand real estate ownership.

You ain’t gonna be one of them.

Clearing the Crap: Title Issues with QCs

Look, a quitclaim deed might seem like a shortcut — until it becomes a roadblock. You can’t resell that house for max profit if there’s a cloud on the title or your claim’s got holes.

Think you’re clever? Cool. But most buyers won’t touch a house that doesn’t have a clear title or proven ownership interest. Using a quitclaim to “clear” title might even make things messier.

It protects you from the grantor’s interest, sure — but not from title defects, prior liens, or messy disputes. You’ll need a quiet title lawsuit or a title certification just to make it sellable.

Bottom line: that “cheap” house might cost you thousands before it’s worth a damn.

Quiet Title Lawsuits: When You Gotta Bring the Hammer Down

You grabbed a deal using a quit claim deed, and now you’re stuck with a messy-ass property title no bank wants to touch. That’s where a quiet title lawsuit comes in — the legal wrecking ball that clears out old claims, shady liens, and deadbeat ex-owners.

This ain’t some $100 courthouse form. A real quiet title action can cost you anywhere from $1,500 to $5,000, and if someone fights back? That cost can skyrocket.

You’re gonna need a solid attorney who knows how the local game is played — someone who understands quitclaim deed requirements in that specific county. Don’t cheap out. If the grantor’s interest is shaky and you skip this step, good luck reselling that real property for anything close to market value.

Title Certification: A Less Aggressive Approach?

If lawsuits make your wallet nervous, you might try a title certification instead. It’s like getting a lawyer to say, “Yeah, this deed looks clean enough,” especially if it came from a tax deed sale or family transfer.

It usually costs around $2,000 and validates the legal document and process behind your quitclaim deed form — including who the hell the grantor was, and whether their transfer even holds weight.

But here’s the thing — a title certification is still weaker than a full quiet title. If you’re selling to cautious buyers or need to convince a lender, they might laugh it off. So weigh your exit strategy. Some buyers are fine with it. Some won’t touch it.

Redemption Periods: Don’t Get Blindsided

You scored a property cheap after a tax deed auction. Nice. But did you check if the state has a redemption period? That’s the window where the old property owner, their cousin, or even a business entity like a bank can swoop in, pay the taxes, and snatch it back — even after you thought it was yours.

Every state’s different, and if you don’t know the law, you’re setting yourself up for heartbreak.

Here’s a nasty surprise: some counties let the person transferring the property get it back without paying you a dime. That’s why understanding quitclaim deed timing and transfer rules is critical.

Due Diligence Ain’t Optional!

Lazy gets you sued.

If you’re thinking of accepting a quitclaim deed without doing your due diligence, just quit the game now. Learn how your county treats property interest. Check if a legal description is included in the deed form. Call the county clerk’s office and verify everything.

And for the love of hustle, use a notary public or attorney when signing. If you don’t, you might find out later that the grantor signs didn’t match the owner’s ID — and guess what? You don’t actually own that house.

Wholesaling, holding, or flipping — due diligence is how the pros play.

The Risk-Reward Spectrum: Are QCs Worth the Headache?

Let’s be real: marketing to quit claim situations? 🔥

Closing on quitclaim deed transfers as the new owner? 😬

High-risk, high-reward. If you’re marketing to family members trying to transfer between generations, or divorcing spouses handing off their half, a quitclaim deed makes sense.

But if a seller demands one, won’t let a title search happen, or gets weird about proving grantor’s ownership — red flag.

Knowing when a claim deed is a tool… and when it’s a trap? That’s the game.

When NOT to Touch a Quit Claim Deed with a 10-Foot Pole

Let me say this loud for the folks in the back: not every quitclaim deed works for investors. In fact, some will blow up in your face faster than a microwave burrito.

If a seller flat-out refuses a general warranty deed and insists on using a quitclaim deed form, you better hit the brakes. That’s the move of someone dodging a title search, hiding behind legal gray areas, and trying to pass the hot potato to you.

And if they act all sketchy about who the grantor owns or can’t explain the legal description? That ain’t just sloppy — it’s shady. Don’t ignore those red flags. A real property owner ain’t afraid to verify their stuff.

Leveraging Public Records: Your Secret Weapon Reloaded

You want the real sauce? Pull those public records yourself. Dig through county clerk and county clerk’s office websites. Look for quitclaim deed transfers that show used to transfer property amounts between $0 and $100 — classic low-dollar quitclaim signal.

Don’t wait for a list broker to spoon-feed you the gems. The parties involved in these deed transfers often go unnoticed, even though the value is off the charts.

Do this right and you’ll find transfer property deals sitting in plain sight — just waiting for a closer to scoop ‘em up.

Beyond the Deed: Property Surveys & Market Intel

You wouldn’t buy a used car without checking under the hood, right? Same goes for real estate. That deed form won’t show you if the property interest actually matches what’s on the ground.

Order a survey. Confirm that property transferred has real, measurable boundaries — especially if it’s from divorcing spouses, family members, or transferred between close family members.

Also, check surrounding comps and who the new deed went to. Use that market intel to sniff out future buyers or agents hungry for a deal. This is how real estate ownership becomes profitable — not painful.

Selling Your Tax Deed Flips: Maximizing the Loot

Let’s say you jumped through the legal hoops. You handled the quitclaim deed requirements, cleared the title defects, and got that marketable title locked in.

Now what?

You’ve got options:

- Sell as-is to a cash buyer

- Renovate and list it retail

- Hold and rent it

If your ownership interest is strong and clean, that deed is now a weapon, not a liability. And yes, even traditional real estate sales can work if the transfer ownership is bulletproof.

But none of this works if the seller owns nothing and just handed you a trash legal document with no legal standing.

Don’t Be a Rookie: The Investor’s Mindset

Here’s what separates investors from dreamers: mindset.

Quit chasing easy. The “top 10 lists” that YouTubers push are full of chumps fighting over scraps. You want real deals? Look where others won’t — like quitclaim deed filings from the county clerk’s office, or transfers from only one spouse after a messy split.

Know your risk. Know your title insurance options. Know how to vet grantor’s ownership before you ever send a contract. Because when the person receiving a junk claim deed ends up stuck with a lawsuit — it’s game over.

Wanna win? Use your head. And understanding quitclaim deeds is part of that.

The Final Word: Go Get That Money, But Don’t Be Stupid

Marketing to quitclaim deed situations is a move for bosses — not babysitters. You’re fishing in waters most real estate investors are too scared or too lazy to swim in. If you know how to leverage public data, talk to the county clerk, and sniff out sketchy legal documents, then these deals can be gold.

But just because you can grab a quit claim deed don’t mean you should. You better know when the grantor owns real equity — and when they’re passing you a lawsuit wrapped in paper.

If the transfer ownership process smells off, if the deed form looks janky, or if the person transferring the property can’t verify their ID — walk. Fast.

You’ve got the knowledge now. Go out, dig smart, vet harder, and turn those overlooked quitclaim deed transfers into real profit. But don’t get sloppy. That’s how fools lose money — and houses.

Bonus: Quitclaim FAQs and Rookie Slip-Ups

Q: Can you use a quitclaim deed between family members?

A: Hell yes — this is one of the most common uses. But still check that grantor’s ownership is legit.

Q: What’s the biggest mistake rookies make?

A: Blindly trusting that a quitclaim deed works the same as warranty deeds. They don’t. One protects you, the other just shrugs.

Q: What’s legally required to record a quitclaim deed?

A: A valid legal description, notarized signature, and in most places, some transfer taxes. Check your local laws — don’t wing it.

Q: Can you use a quitclaim in traditional real estate sales?

A: You can, but you’d better disclose it and expect fewer interested buyers unless you’ve already cleaned up the title.

So yeah, you better understand quitclaim deed faqs before you get fancy with this paperwork. Paper ain’t protection unless it’s done right.

💰 Mic Drop Conclusion

You just got the damn blueprint.

Quitclaim deeds are a power move — if you play ’em right. They’re messy, quiet, off-radar, and packed with potential. But don’t confuse hustle with recklessness.

Vet the deed. Verify the grantor. Pay for the title search. Get the title insurance. That $2K you drop now could save your ass from a $20K disaster later.

And when you see a seller dancing around your questions, ask yourself: Would I take a handshake from this person in a dark alley for 100 grand? If the answer is “hell no,” then why would you accept their claim deed?

Now go get that money. But do it like a real Property M.O.B. soldier — sharp, smart, and two steps ahead.