If You Ain’t Checking, You’re Guessing (And That’s How You Go Broke)

Let me keep it all the way real: jumping into a deal without doing your due diligence is how you end up with a money pit instead of a paycheck. I don’t care how “motivated” that seller sounds or how sweet the neighborhood looks — if you don’t dig deep, you’re setting yourself up to bleed out money before you even close.

This ain’t just some boring legal term your real estate lawyer mumbles about — it’s your financial body armor. The streets don’t care about feelings, and neither do bad deals. Due diligence is what separates the hustlers from the hopeful.

Due Diligence Ain’t Optional — It’s the Gameplan

So what is this “due diligence” everyone talks about?

It’s the deep-dive you do before you commit to buying a house, flipping a property, or assigning a deal. You’re inspecting, researching, verifying — turning over every rock. Think of it like inspecting a used car before you buy it… except the engine is worth six figures and it might have termites.

This process ain’t just about avoiding bad deals — it’s about making sure you’re buying the right property with the right expectations. You ain’t just a buyer — you’re a business. So treat this like a business move, not a gamble.

When you’re ready to make an offer, having the right contract matters. This is the exact wholesaling contract we use so you can move forward without guessing.

Your Due Diligence Period = Exit Strategy Without the Drama

Most contracts give you about 10 days to do your homework. That’s your “get out of jail free” card.

You’ve got that window to get inspections, run comps, verify liens, talk to a mortgage lender if needed, and basically figure out if the property is hot or hazardous. And here’s the real gem: during this period, you can back out for any reason.

Did the home inspection show a cracked slab? Out.

Did the seller start acting shady? Out.

Did your income take a hit and you can’t afford the monthly mortgage payments anymore? Out.

Use that window. Don’t sit on your hands and hope for the best — this is your chance to take control of the buying process.

The Lazy Investor Pays Twice — Don’t Be That Person

Let’s be blunt: sellers lie. Not all of them, but enough to make this point crystal clear.

They’ll gloss over closing costs, hide homeowners insurance nightmares, downplay car payments, or forget to mention that their cousin did the electrical work without a permit. They want to sell, you want to buy — but you’ve got to protect your own bag.

If you don’t verify it yourself, those “minor problems” will turn into major financial wounds. That’s why the diligence process is YOUR job, not theirs.

Break It Down for the Seller or Pay Later

Truth bomb: most sellers don’t know jack about the closing process. They’re guessing, assuming, or just flat-out confused. So you need to walk them through it like they’re your slightly tipsy uncle at a cookout.

Go over the final price, closing day expectations, who’s paying for what, and every single dollar tied to the deal. If you don’t, they’ll get blindsided, and a blindsided seller will walk — or worse, sue.

Don’t ever assume they know what you know. That’s a rookie mistake. Say it out loud, write it down, make it stupid-simple.

Spot the Landmines Before They Blow Up Your Profit

So you’ve got a deal cooking and the seller seems cool — that’s cute. Now it’s time to rip the cover off this property and see if it’s got termites in the bones or liens on the title. That’s the real due diligence play. Because in this competitive market, skipping this step is how you buy someone else’s problems.

Here’s what to check before you throw your money into a deal you’ll regret:

- Delinquent Property Taxes: If the seller hasn’t been paying Uncle Sam, guess what? You inherit that debt when you buy the house. Always check with the county records or title company.

- Code Violations: Some of these properties been through hell. You might see a “fixer-upper,” but the city sees a fire hazard. Get the records and check for issues that could block you from flipping or renting.

- Nuisance Liens & Judgments: These ain’t just legal notes — they’re financial claws ready to sink into your purchase price. Unpaid fines, court judgments, and weed removal bills can hold up your closing or gut your profit.

The Hidden Snares Lurking in the Financials

Now let’s talk about the less obvious traps — the ones that don’t show up in listing photos but will show up on your bank statements.

- Mortgages: Always know how many mortgages are on the property. Don’t assume there’s just one. You might have a second or even a private mortgage insurance policy attached.

- Other Liens: You’ve got tax liens, mechanics’ liens, HOA liens — they don’t disappear just because the seller smiles. Clear these before you sign anything.

- HOA Fees: If there’s a homeowners association involved, ask for the homeowners insurance policy, fee schedule, and any upcoming special assessments. Hidden monthly payments can eat into your ROI fast.

Ownership Surprises & Zoning Nightmares

This is where things get real messy, especially if you don’t have a solid real estate agent or title company to back you up.

- Who Actually Owns It?: Just because one person signed your contract doesn’t mean they own the whole damn thing. Heirs, divorces, and probate can put you in court real quick if you don’t verify ownership.

- Zoning Rules: Is the property still zoned for residential? Can it be split or developed? If your investment strategies include converting the house into a duplex or rental, make sure zoning allows it.

- Pending Foreclosure: If the lender already filed on the house, the clock is ticking. This affects your purchase, your closing timeline, and your mortgage process if financing is involved.

Know Your Numbers or Watch Them Disappear

Let me say this again for the people in the back: you better know your numbers. This is when your mortgage broker or lender is your best friend.

- The loan amount, the down payment, the closing costs, the insurance, the monthly income potential, and the diligence steps needed to back them all up.

Deals don’t fall apart at the closing table. They fall apart when you skipped the home appraisal, ignored the mortgage loan structure, and guessed your income numbers.

Smart Hustlers Use Smarter Tools (Especially in Indy)

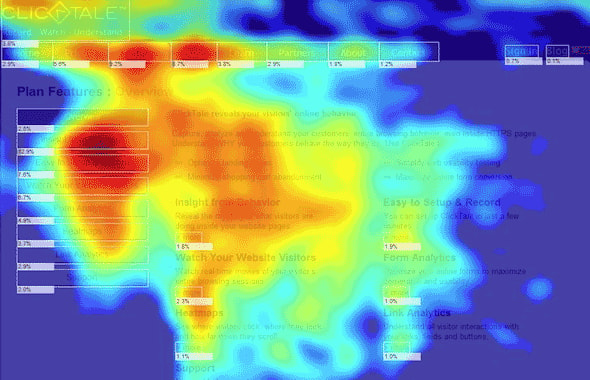

If you’re working deals in Indianapolis or any local market, you can’t just rely on gut feelings and drive-bys. You need data, insights, and digital recon. That’s part of your due diligence — not optional. It’s your wholesale real estate radar. And if you’re flipping or assigning in a competitive market, you need to move fast and move smart.

Digital tools don’t just give you an edge — they keep you from getting played.

Realtor.com: Your Free Spyglass for Neighborhood Intel

You don’t need to be a licensed real estate agent to benefit from Realtor.com. This tool is your street-view sniper scope.

- Neighborhood Filters: Narrow your search by price, school district, or beds and baths. You’re not just house hunting — you’re building a buyer profile match.

- Map Layers: Overlay crime, school ratings, or local market conditions. You’re not just buying a box with walls. You’re selling a new home experience to your cash buyers or end users.

- Buyer Appeal: For families, school zones matter. Especially if your investment property is 3+ bedrooms, school quality can boost your exit value and buyers pool.

Use this data during your diligence process. You don’t want your real estate investor buddies to pass on your deal because you missed a red flag on the block.

Crime Heat Maps: Read Between the Sirens

Let’s be honest — some streets in Indy look pretty on Google Maps but feel like warzones in real life. Crime heat maps can help you dodge bad pockets. But you gotta read it right.

- Call Volume ≠ Danger: Just ’cause the map is red doesn’t mean it’s a no-go. Sometimes it’s all noise complaints and petty stuff.

- Known Hotspots: South of Lawrence? 42nd & Post? You better know what you’re walking into. Your buyers sure do.

Your due diligence needs to match the expectations of your end-buyer. Whether that’s a landlord, flipper, or family, they’re all gonna ask the same thing: “Is this property safe and worth it?”

Flood Zones & Noise Levels: Don’t Get Caught Slipping

Here’s what rookies miss — and what costs them deals.

- Flood Risk: Indy’s got flood-prone areas. If your property is anywhere near Rocky Ripple or the White River, check that FEMA map. Insurance premiums in those zones can destroy your numbers.

- Noise Check: If you’re near train tracks, interstates, or flight paths, it impacts the right property perception. Loud = less desirable. Period.

All of this should be on your checklist during due diligence. You’re not just flipping walls — you’re flipping lifestyle.

Lifestyle Matters: Smart Investors Sell More Than Bricks

Gone are the days when a real estate deal was just about the square footage. If you’re serious about wholesale real estate, you need to consider lifestyle features that raise value.

- Transit & Trails: Proximity to the Monon Trail, bike lanes, and mass transit boosts desirability — especially to young families and first-time homebuyers.

- Walkability: Can your buyers walk to coffee, groceries, or parks? These are the “unseen” perks that raise value.

You’re not just doing due diligence on the house — you’re checking how that house fits into someone’s real life. That’s how you lock in deals, get your income, and build your rep as a serious real estate investor.

Connected Investors: Your Digital Playground for the Hustle

This platform’s been a game-changer. If you’re serious about wholesale real estate, this is where you go to meet your tribe, get funding, and find deals faster than the next guy.

- Networking Hub: Think Facebook meets MLS but built for people like us — the deal finders, the flippers, the silent killers in the game.

- Funding Fast: Need capital for that investment property you just locked up? This place connects you to mortgage lenders, private money, and hard money backers — no suit required.

- Marketplace: List your deals. Find theirs. It’s like Craigslist but for real hustlers.

Your due diligence goes beyond just checking the property. You’re vetting the market, your numbers, your network, and your strategy. And if you’re not using tools like Connected Investors, you’re leaving money on the table.

Money Talks — Get It Before the Deal Walks

You can have the perfect wholesale real estate deal locked up, but if your lender ghosts you or your funding falls through, you’re dead in the water. Fast cash wins in this game — and waiting on a mortgage lender that moves like molasses is how deals fall apart.

This is where the Connected Investors platform hits hard. It connects you with people who understand investment property plays — not people asking you for your favorite color and bank statements.

You want to win? You need options.

Private & Hard Money: Your Fast Lane to Flips

Forget begging traditional banks to fund your deal. That’s rookie stuff.

- Private Lenders: Individuals willing to bet on you — fast decisions, flexible terms.

- Hard Money Loans: High interest, short term, zero red tape. It’s not cheap, but it’s fast — and speed is everything in real estate.

- Funding Fit: Know your numbers. Make sure your monthly payments and interest rates still leave room for profit.

Use your due diligence window to secure funding, not panic about it later. This is what separates amateurs from deal-makers.

List Fast, Flip Faster — Leverage the Marketplace

Once you’ve got that property locked up, it’s time to get loud.

- List Your Deal: Connected Investors lets you show off the right property to other cash buyers looking for solid returns.

- Be Clear: Lay out the purchase price, estimated ARV, rehab budget, and your role in the deal (are you assigning? wholesaling? flipping?)

- Move Units: The more active you are, the faster you build your list of trusted buyers and repeat partners.

This is how real estate investors stack wins: find, fund, flip, repeat.

Community Game Is Strong — Build Your Network

This business ain’t solo. You need other hustlers in your corner. The forums, feeds, and groups inside these platforms? Gold.

- Find Local Partners: Tag by zip code or specialty. Looking for someone with experience in closing day drama or zoning headaches? They’re out there.

- Learn From the Grind: Veterans share everything — from deal breakers to interest rate strategy. You just have to listen.

- Stay Sharp: This is part of your diligence — not just on the property, but on YOU. Level up by surrounding yourself with people doing real volume.

You’re not just building a buyer’s list. You’re building your business.

Knowledge Is Power — But Only If You Use It

Look, nobody’s born knowing how to run a due diligence checklist or analyze the housing market. You learn by doing — and studying.

Platforms like Connected Investors drop articles, deal analysis, case studies, and breakdowns that’ll keep your skills sharper than a brand-new drywall blade.

- Articles Galore: From first-time homebuyers to seasoned wholesalers, there’s content for every stage.

- Data-Driven Moves: Tap into numbers that help you understand local market trends and home appraisal impact.

- Never Stop Learning: You don’t need to know everything. You just need to know more than the seller.

This is how you keep your edge in wholesale real estate — stay curious, stay humble, stay dangerous.

Wholesale Ain’t for Wimps — You Need Grit and Guts

Let’s not sugarcoat it: wholesale real estate is a grind. There will be cold leads, flaky buyers, hidden repairs, and shady sellers. You’ll get ghosted, doubted, and outbid. But if you stay locked in — and you master the due diligence game — you’ll outlast every lazy wannabe in your market.

You’re building something. A brand. A business. A hustle that pays you not just now, but for years to come.

The path ain’t easy, but it’s worth it.

Early Diligence = Better Deals, Fewer Headaches

Most mistakes happen before the ink even dries. Not checking title? Skipping the home inspection? Ignoring local market conditions? That’s how you end up doing deals that leave you broke, not ballin’.

The best real estate investors are the ones who slow down just enough to get it right. That doesn’t mean hesitating — it means verifying.

Know what kills profits? Rushing past red flags.

- Don’t assume that homeowners handled the paperwork.

- Don’t assume a loan will be approved without reviewing the debt to income ratio.

- Don’t guess on a rehab budget — get actual numbers.

- Don’t fall in love with a house you haven’t verified is structurally sound.

Don’t Be a Ghost — MOB Up and Stay in the Game

You’re part of something bigger now. Whether you’re flipping your first investment property or scaling to 10+ deals a year, your process is everything.

And if you’re learning from the MOB — you ain’t just hustling, you’re leveling up the real estate game for yourself and your crew.

Here’s how to lock in your edge:

- Engage with the community: Comment, share your wins and losses. You learn more by teaching.

- Follow the data: Pay attention to housing market shifts, zoning updates, and closing trends.

- Refine your system: Your diligence process, your lead follow-up, your lender pipeline — all of it needs tuning.

You can’t get too comfortable. As soon as you do, that’s when the market humbles you.

Final Thought: Protect Your Bag, Build Your Legacy

Real talk — every property you look at is either a step forward or a trap. It’s either going to build your wealth or drain your account. And the only thing that determines that?

Due diligence.

Don’t get caught slipping because you were excited. Don’t let emotions override evidence. Don’t overpay just to feel like you closed a deal.

You’re not just flipping houses — you’re building freedom. And that only happens when you work smart, stay sharp, and treat due diligence like it’s life or death.

Because sometimes? It is.

Join the MOB — Where Hustlers Level Up

You’re not doing this alone. Whether you’re a hall of famer in wholesale real estate figuring out how to qualify for funding or prepping your first home purchase, we’ve all been there.

The MOB is here for:

- Helping you avoid deal breakers

- Sharing tricks to sell faster

- Connecting with vetted real estate agents

- Breaking down the home buying process for first-time homebuyers

We might clown on each other — and yeah, realtors still get on our nerves — but it’s all love. This crew is how you keep learning, keep growing, and keep stacking those wins.